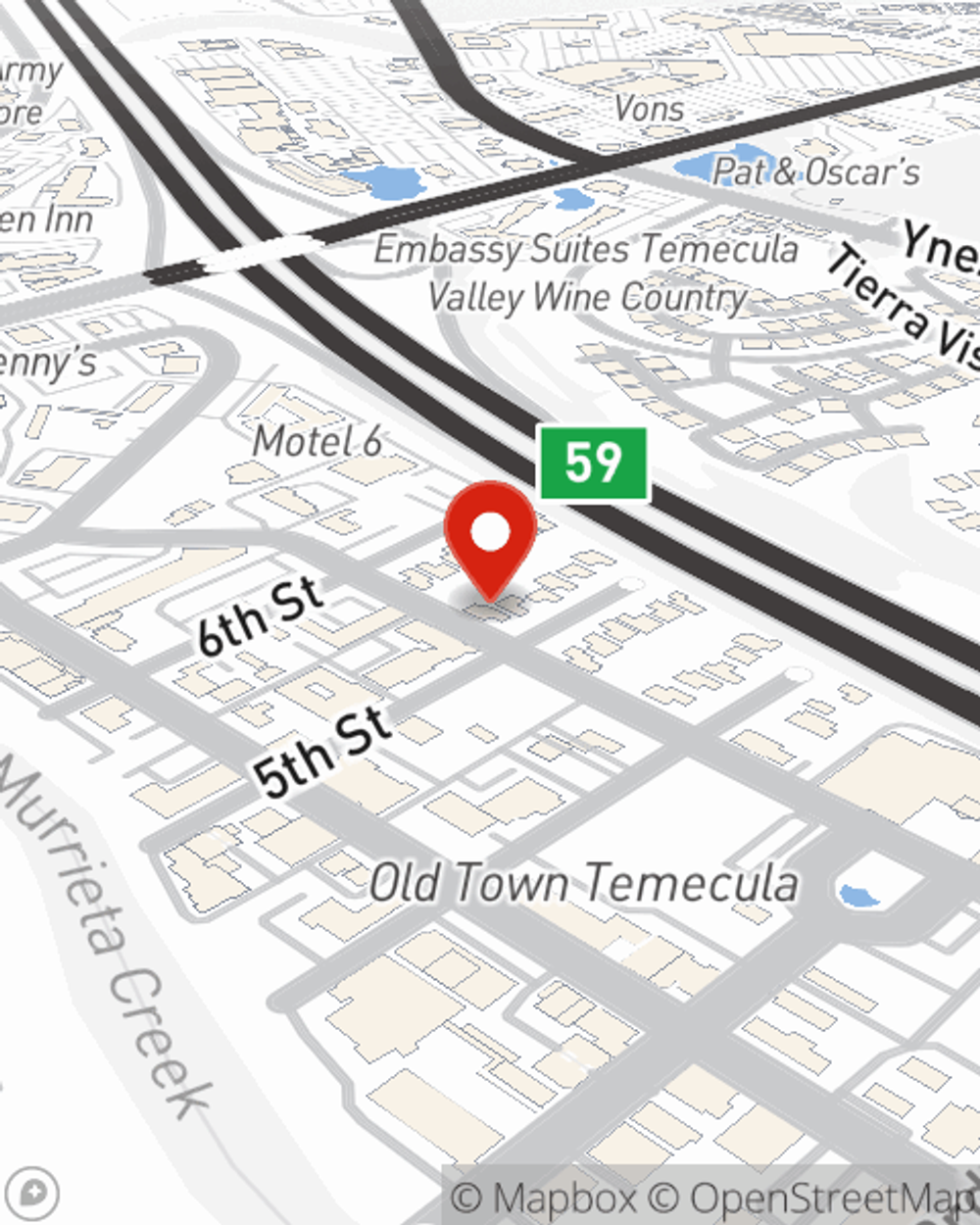

Insurance in and around Temecula

Need insurance? We got you.

Cover what's most important

Would you like to create a personalized quote?

A Personal Price Plan® That’s Uniquely You

You’ve worked hard to get to where you are. But the world can frequently throw the unexpected at you. Let State Farm® insurance help protect you, your loved ones and the life you’ve built. Develop a coverage plan that protects what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts, you can create a solution that’s right for you. Contact Julie Ngo today for a Personalized Price Plan.

Need insurance? We got you.

Cover what's most important

Insurance For Every Step Of The Way

As the largest insurer of automobiles and homes in the U.S., State Farm is equipped and experienced when it comes to helping you protect the life you've built with excellent service, great claims service and competitive prices.

Simple Insights®

What to do if your car has flood damage

What to do if your car has flood damage

If floodwaters partially or fully submerge your car, it can mean extensive damage and costly repairs. Here's what to do after the waters recede.

Are you saving enough for college? Find out with this calculator

Are you saving enough for college? Find out with this calculator

Use this calculator to determine how much should be saved for future college costs.

Simple Insights®

What to do if your car has flood damage

What to do if your car has flood damage

If floodwaters partially or fully submerge your car, it can mean extensive damage and costly repairs. Here's what to do after the waters recede.

Are you saving enough for college? Find out with this calculator

Are you saving enough for college? Find out with this calculator

Use this calculator to determine how much should be saved for future college costs.