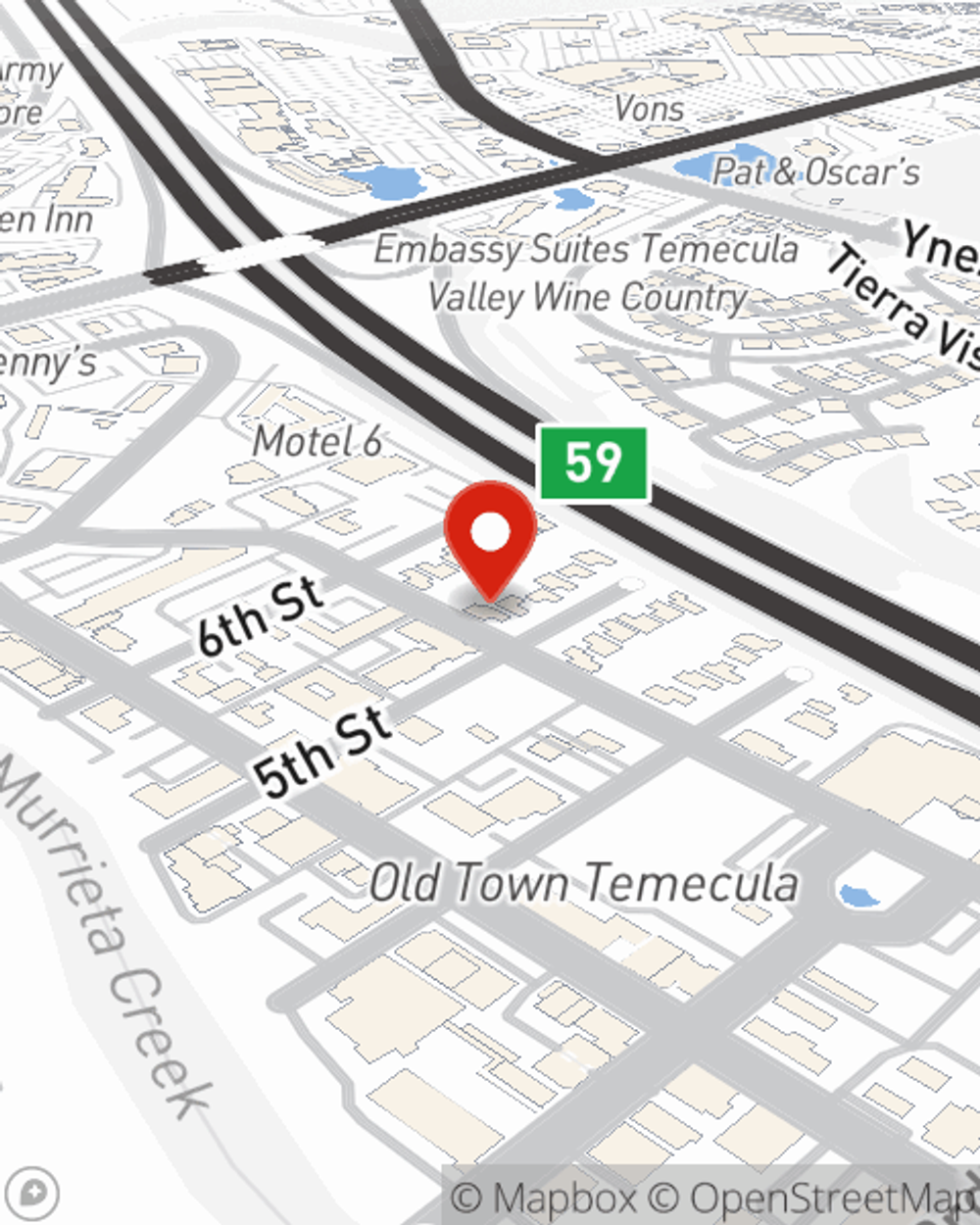

Business Insurance in and around Temecula

One of Temecula’s top choices for small business insurance.

Helping insure small businesses since 1935

State Farm Understands Small Businesses.

Worries are unavoidable when you own a small business. You want to make sure your business and everyone connected to it are covered in the event of some unexpected problem or catastrophe. And you also want to care for any staff and customers who become injured on your property.

One of Temecula’s top choices for small business insurance.

Helping insure small businesses since 1935

Insurance Designed For Small Business

Protecting your business from these possible accidents is as easy as choosing State Farm. With this small business insurance, agent Julie Ngo can not only help you design a policy that will fit your needs, but can also help you submit a claim should an issue like this arise.

Don’t let concerns about your business stress you out! Get in touch with State Farm agent Julie Ngo today, and see how you can meet your needs with State Farm small business insurance.

Simple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.

Julie Ngo

State Farm® Insurance AgentSimple Insights®

Protect your business property from slip and falls

Protect your business property from slip and falls

Decrease the chances of slips, trips and falls at your business with proper maintenance and safety procedures.

How to collect rent from tenants

How to collect rent from tenants

There are many ways to collect rent from your tenants. It's important to consider the one that best suits your needs.